The 2016 presidential primary election will take place in New York State on Tuesday, April 19.

It’s not too late to register to vote, or to update your address or party affiliation. Voter registration forms must be postmarked no later than March 25 and received by no later than March 30. To obtain a voter registration form, go to your local post office or to http://www.elections.ny.gov/.

At the time this went to press, there were two Democratic and six Republican candidates running in the primaries to be their party’s nominee for President. With delegates awarded from the first few states, both parties’ primary fights are up in the air. They may be long, hard-fought slogs right down to the conventions this summer, when the Republicans will converge on Cleveland (July 18-21) and the Democrats on Philadelphia (July 25-28).

A lot hangs in the balance for working people. The recent death of Supreme Court Justice Antonin Scalia reminds us how critical to the fights for healthcare, workers’ rights, and economic security a President’s legal and regulatory appointments can be. All around the country, there are campaigns around wages, family leave, childcare, elder care, healthcare, and education that could well receive federal action in the coming years. The status of immigrants, matters of war and peace, and the health of our planet all depend on political questions: who is in power, and what is their agenda?

NYSNA will help keep our members informed about this critical election, here in their own words is a brief outline of the policies of each candidate. When New York heads to the polls on April 19, NYSNA members will, as always, carry our patients and communities with us when we pull the lever.

Democratic Primary Candidates

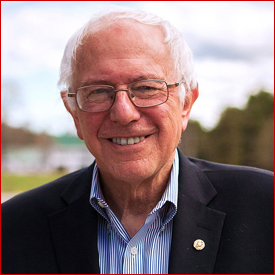

Senator Bernie Sanders

Senator Bernie Sanders (I – VT)

Campaign Pledges

INCOME INEQUALITY

Jobs program: Sanders’ approach is in the tradition of President Franklin Delano Roosevelt: striving to provide every American with a job at a living wage through government action and assistance to small businesses. His program calls for raising taxes on the wealthiest Americans, taxing Wall Street speculative trading and large inheritances, closing loopholes, and devoting revenue foremost to job creation. Sanders will invest $1 trillion in new revenue to hire 13 million Americans to rebuild infrastructure and $5.5 billion to create 1 million jobs for disadvantaged youth. Sanders would seek to reverse trade policies like NAFTA, which led to the closing of thousands of U.S. factories and millions of jobs lost. Sanders opposes the Trans-Pacific Partnership for similar reasons.

Sanders would also protect quality jobs by strengthening the right to organize unions through the Employee Free Choice Act.

Wages: Sanders recently introduced a bill in the Senate to raise the federal minimum wage from $7.25 per hour to $15. “I think if you work 40 hours a week, you have a right not to live in poverty,” he says. On his website, he writes, “The issue of wealth and income inequality is the great moral issue of our time, it is the great economic issue of our time, and it is the great political issue of our time.”

Paid Family Leave: Sanders supports 12 weeks of paid family leave. “The United States is the only developed nation in the world without guaranteed, paid parental leave. A democratic, civilized society should guarantee these benefits for the working families and middle class of our country,” he says on his website.

Wall Street: Sanders believes that a small group of billionaires, either financiers or others with close ties to Wall Street, are subverting the nation’s democracy. He says that Wall Street is at the center of a “rigged” economy and that fraud was, and remains, widespread and highly destructive. Main Street has been decimated yet virtually no one who engaged in the massive fraud resulting in the financial collapse of 2007-08 was charged with a crime, he stresses. The big banks have gotten bigger since the collapse, raising the risk of yet another collapse and keeping alive “Too Big to Fail” policies of the Bush era.

Sanders points out that the government provides capital to banks at near-zero interest rates; yet consumers pay substantial, often double-digit, interest rates. This gouging in the financial sector is but a piece of the “rigged” system that provides hedge fund traders, bankers and brokers billions in salaries and bonuses.

Sanders would break up the big banks through a return to the protections of the Glass-Steagall Act, an FDR-era control on banking abuse.

Tax plan: Sanders proposes a broad tax plan aimed at the very rich, increasing the scope and rates of the estate tax, including an additional billionaire’s surtax of 10%, ending tax breaks for dynasty trusts, increasing payments to the Social Security trust fund from those making more than $250,000 a year, ending tax breaks for capital gains and dividends for the wealthy. He supports a tax on Wall Street speculation that would raise $300 billion annually and reduce high frequency trading and other “casino-like” activities.

HEALTHCARE

Sanders believes that healthcare is a right, not a privilege, and that the U.S. urgently needs to join the ranks of nations with national healthcare systems. “The only long-term solution to America’s healthcare crisis is a single-payer national health care program,” he says.

Sanders supports single payer (Medicare of All), carried out through a payroll tax. He says that the tax would amount to far less money from family budgets than what the vast majority of Americans pay in total annual healthcare costs under the current system. Commercial health insurance would be replaced by a system that gives priority to patient need, and providers, including hospitals, would remain in tact.

EDUCATION

College: Sanders believes that free access to a university education should be a top national priority. His website provides: “Make tuition free at public colleges and universities.” He advocates a variety of steps to eliminate financial barriers to getting a higher education.

Student Debt Assistance: Sanders has called for an end to the “federal government … making a profit on student loans.” He would “allow students to use need-based financial aid and work study programs to make college debt free. Rates for college loans should be “heavily reduced.”

Early Childhood Education: Sanders supports comprehensive childhood education in the U.S. Five years ago, he introduced the Foundations for Success Act, which would have awarded a grant to states allowing them to create an Early Care and Education System. The bill, had it passed, would have given residents the opportunity to enroll children, ages 6 weeks to kindergarten, in an early care and education program on a full time basis. He continues to support a national system of early childhood care, including universal pre-Kindergarten for 4-year olds.

Charter schools: Sanders is a staunch supporter of public schools. He opposes “privately-run” charter schools. He has not, however, made clear what he means, as most charter schools are part of public systems. He did say recently: “I believe charter schools should be held to the same standards of transparency as public schools.”

CRIMINAL JUSTICE SYSTEM

Incarceration: “I consider reforming our criminal justice system one of the most important things that a president of the United States can do,” says Sanders, calling the U.S. prison system an “international embarrassment.” He routinely points out that the U.S. incarceration rate is the highest in the world and says it would change under his presidency. He links job creation and educational opportunity to reduced rates of incarceration.

Sanders also calls for an end to for-profit prisons, the removal of marijuana from the federal list of controlled substances, elimination of the death penalty and end mandatory minimum sentencing. “Too many lives have been destroyed because of police records,” Sanders says, noting the issue affects both white and African Americans.

The disproportionately high rate of incarceration for African American males and the criminalization of school-aged African Americans he terms a “tragedy” – “the destruction of an entire generation.”

Sanders wants to keep nonviolent offenders out of jail with alternative sentencing: rehabilitation and community service programs instead of jail time.

Youth programs: Sanders believes in government action for jobs. He supports full-time work for young adults so that they can achieve stability, have decent living conditions and build a future. Sanders introduced the Employ Young Americans Now Act last year, a bill that would spend $4 billion to provide one million jobs for young Americans ages 16-24. In addition, the bill allocates $1.5 billion for job training for hundreds of thousands of youth who, in many cases, finished high school but were unable to attend college and had few job opportunities

Guns: Sanders supports only a partial ban on assault weapons and has called for “common sense gun reform.” In the debates he said, “I voted for instant background check, which I want to see strengthened and expanded. I voted to end the so-called gun show loophole.” Sanders voted against liability for gun dealers

CLIMATE CHANGE & ENVIRONMENTAL JUSTICE

Energy and new jobs: Sanders is calling for a cut in U.S. carbon pollution of 40% by 2030 and by over 80% by 2050 by putting a tax on carbon pollution, repealing fossil fuel subsidies and making massive investments in energy efficiency and clean, sustainable energy such as wind and solar power.

Concretely, he is introducing the Clean Energy Worker Just Transition Act to provide comprehensive benefits to workers to transition to making solar panels, wind turbines, and batteries.

Sanders’ supports the creation of a Clean-Energy Workforce of 10 million good-paying jobs by creating a 100% clean energy system. He supports transitioning toward a completely nuclear-free system for electricity, heating, and to clean up the air and water, and decrease U.S. dependence on foreign oil.

Public health system: Sanders supports the creation of “a national environmental and climate justice plan, and increased funding to public health departments” according to his website. He underscores “the heightened public health risks faced by low-income and minority communities. Low-income and minority neighborhoods will continue to be the hardest hit if we don’t act to stop climate change now.”

Key Endorsements: National Nurses United, Communications Workers of America, MoveOn.org, Working Families Party

Former Secretary of State Hillary Clinton

Former Secretary of State Hillary Clinton

Campaign Pledges

INCOME INEQUALITY

Jobs program: Clinton relies on tax incentives for business to achieve job growth, a “market” approach. For example, she proposes “a new $1,500 apprenticeship tax credit” for business to train and hire. She also has called for “reviving the New Markets Tax Credit and Empowerment Zones to create greater incentives to invest in poor and remote areas” and supports “a new plan to reform capital gains taxes to reward longer-term investments that create jobs.” Clinton supports only a partial government investment in jobs, calling for "an infrastructure bank that can channel more public and private funds to finance airports, railways, roads, bridges and ports.”

Clinton supported the Trans-Pacific Partnership as Secretary of State which was opposed by the labor movement due to the number of jobs that would be lost. Now, as a candidate she opposes it.

Wages: Clinton wants to raise the federal minimum wage to $12 an hour from the current $7.25 which would lag behind the current rate of inflation and why most New York elected Democrats support $15 an hour. She also will “encourage other communities to go even higher.”

Paid Family Leave: Clinton backs a “guarantee of up to 12 weeks of paid family and medical leave” with “at least a two-thirds wage replacement rate for workers.” She will “pay for paid leave by making the wealthiest pay their fair share — not raising taxes on working families.”

Wall Street: Clinton says she would work against the so-called “Too Big to Fail” banking system. She supports Dodd-Frank, a law passed after the bank bailout that raised the bar on Wall Street regulation but has been criticized as inadequate in its control of banks and protection of consumers. She says she will “offer plans to rein in excessive risks on Wall Street and ensure that stock markets work for everyday investors, not just high frequency traders and those with the best – or fastest – connections."

Clinton has not endorsed a tax on Wall Street speculation, which would raise billions in tax revenue to create jobs while curbing high frequency trading and financial misdeeds that led to the 2008 crash of the economy and the Great Recession.

Clinton opposes reinstituting the Glass-Steagall Act, a law that controlled banking and commercial trading mergers and protected consumers from abuse.

Clinton has been criticized for taking donations and personal fees for speeches from the big banks that were responsible for the 2008 crash and received the biggest bailout in history from the government treasury.

Tax plan: Clinton supports the “Buffett Rule,” requiring people earning more than $1 million a year to pay at least a 30% tax rate. She also promises to tighten loopholes like the “carried interest loophole” which lets wealthy financiers pay low tax rates. She proposes expanding the estate tax to those worth more than $3.5 million (down from the current $5.5 million). She proposes a 4% surtax on all income over $5 million.

HEALTHCARE

Like her jobs plan, Clinton favors a “market” approach to healthcare, relying principally on the commercial health insurance industry that receives enormous profits from consumer paid premiums that continue to rise. She sees the achievement of universal access to care through the expansion of the ACA and Medicaid to states and most recently she added a call for a "public option" to broaden the choice of insurance plans ; Clinton supports a tax credit of up to $5,000 per family to offset only a portion of excessive out-of-pocket and premium costs above 5% of income and provide other tax credits. She will invest in navigators, advertising and other outreach activities to make ACA enrollment easier. Clinton does not support a single payer (Medicare For All) system that would cover everyone and end gouging of consumers by private insurers.

EDUCATION

College: Clinton would enhance federal assistance on education in a “New College Compact” that would also require states to increase their own spending and universities to control spending. Families still would need to contribute, but students wouldn’t have to take out loans to attend public schools.

“I believe that we should make community college free. We should have debt-free college if you go to a public college or university. You should not have to borrow a dime to pay tuition,” Clinton says. “I disagree with free college for everybody. I don’t think taxpayers should be paying to send Donald Trump’s kids to college.”

Student Debt Assistance: Clinton’s “New College Compact” provides that “everyone who has student debt should be able to finance it at lower rates.”

Early Childhood Education: Clinton supports universal education for 4-year olds and would “invest in early childhood programs like Early Head Start” to “ensure that every 4-year-old in America has access to high-quality preschool in the next 10 years.”

Charter schools: Long a supporter of charter schools and the stream of public money sent to support them, Clinton recently backed away from this position.

CRIMINAL JUSTICE SYSTEM

Incarceration: Clinton would reduce mandatory minimum sentences for nonviolent drug offenses by cutting them in half. She would encourage the use of “smart strategies” —such as police body cameras—and end racial profiling to rebuild trust between law enforcement and communities. Her campaign does not accept contributions from federally registered lobbyists or PACs of private prison companies.

Youth programs: Clinton underscores a federal apprenticeship program as a path to reducing youth unemployment. She proposes rewarding businesses with a tax credit of $1,500 for every apprentice they hire. She says that the program would encourage businesses to take on more young workers.

Guns: Clinton has promised to “strengthen background checks and close dangerous loopholes in the current system,” including Internet sales. She wants to “hold irresponsible dealers and manufacturers accountable.” Her plan calls for “repealing the law that prevents victims of gun violence from suing manufacturers and dealers, and backing punitive action against “bad-actor” dealers that “knowingly supply straw purchasers and traffickers.”

CLIMATE CHANGE & ENVIRONMENTAL JUSTICE

Energy and new jobs: Clinton says she will create good-paying jobs by making the U.S. “the clean energy superpower of the 21st century.” She will set national goals to have 500 million solar panels installed, cut energy waste in homes, schools, and hospitals by a third and reduce American oil consumption by a third.

Clinton plans to revitalize coal communities so that coal miners, power plant operators, transportation workers, and their families are helped through economic diversification and job creation.

Clinton did, however, encourage developing countries to sign deals with American fossil fuel companies to extract their shale gas through fracking. As a senator, she voted in favor of a bill opening new Gulf Coast areas to offshore oil drilling.

Public health system: Clinton pledges to “defend, implement, and extend smart pollution and efficiency standards, including the Clean Power Plan, which will prevent 3,600 premature deaths and 90,000 asthma attacks annually.”

Key Endorsements: Service Employees International Union, American Federation of Teachers, Planned Parenthood, National Organization for Women.

Republican Primary Candidates

Donald J. Trump

Donald J. Trump (Businessman/Celebrity)

Campaign Pledges

Immigration: Mr. Trump wants to build a 2,000 mile wall underlying four states from California to Texas. In his campaign announcement speech, he said, “I will build a great, great wall on our southern border and I will make Mexico pay for that wall.”

Syrian refugee crisis: Trump wants to ban all Muslims from entering the U.S. A campaign press release stated, “Donald J. Trump is calling for a total and complete shutdown of Muslims entering the United States until our country’s representatives can figure out what is going on.”

Wealth inequality: Trump doesn’t want heirs to fortunes, like himself, to have to pay any taxes on their inheritance. From his campaign website: “No family will have to pay the death tax. You earned and saved that money for your family, not the government. You paid taxes on it when you earned it.”

Tax Plan: Mr. Trump’s plan calls for capping the amount of owners’ business income that can be paid in taxes, eliminating the estate tax, and reducing the number of tax brackets and rates. According to the Tax Policy Center, his plan would lose the US $9.5 trillion in revenue.

Key Endorsements: Former Alaska Governor Sarah Palin, Conservative Pundit Ann Coulter, the American Freedom Party (a white supremacy organization classified as a hate group by the Southern Poverty Law Center)

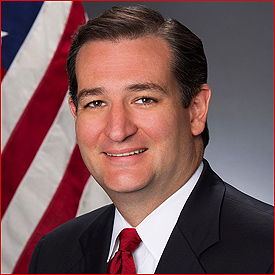

Senator Ted Cruz

Senator Ted Cruz (R – TX)

Campaign Pledges

Marriage discrimination: Senator Cruz thinks states should have a right to discriminate against gay couples. He told a right-wing radio host that court cases upholding marriage equality constitute “a real threat to our liberty.”

Influence of wealth on elections: Cruz accused Democrats who were trying to give Congress the power to regulate campaign financing of attempting to “expressly repeal the free-speech protections of the First Amendment.”

Reproductive health: Cruz wants to eliminate Planned Parenthood and, on his campaign’s website, says “We shouldn’t send $500 million of taxpayer money to fund an ongoing criminal enterprise.” Furthermore, “I intend to... instruct the Department of Justice to open an investigation into these videos and to prosecute Planned Parenthood for any criminal violations.”

Tax Plan: Cruz would eliminate the Payroll Tax, the Estate Tax, and the Corporate Income Tax, and replace them with a flat tax of 10% for labor income and 16% for business income. According to the Tax Policy Center, his plan would cause the U.S. to lose $8.6 trillion in revenue over a decade.

New York: Cruz has attacked New Yorkers, criticizing what he terms “New York values.” He describes New Yorkers as “socially liberal or pro-abortion or pro-gay-marriage” and inclined to “focus around money and the media.”

Key Endorsements: Georgia Right to Life, Gun Owners of America, National Organization for Marriage

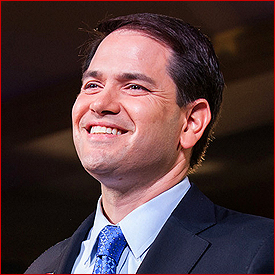

Senator Marco Rubio

Senator Marco Rubio (R – FL)

Campaign Pledges

Healthcare reform: Senator Rubio wants to repeal the Affordable Care Act and replace it with an entirely privatized healthcare system. According to his campaign website, “Obamacare has revealed the painful consequences of placing our faith in big government. Government’s ambitions may be limitless, but its abilities are not. The free market, when allowed to function as intended, has no such limitations. It has an inexhaustible ability to empower our people and meet their needs.”

Iran: Rubio wants to reverse Obama’s diplomatic gains with Iran. He has said that as president he would “absolutely” re-impose sanctions on Iran and that he “will back this up with a credible threat of military force” against the country.

Climate change: Rubio wants to allow oil and gas corporations to wreck the environment. His website demands that we “Immediately Approve the Keystone XL Pipeline,” “Expedite Approval of American Natural Gas Exports,” “Stop President Obama’s Carbon Mandates.”

Tax Plan: Rubio’s tax proposal would convert the federal income tax into a consumption tax by not taxing investment income of individuals and by converting the corporate income tax into a cash-flow consumption tax. It would replace most deductions and exemptions with a universal credit and eliminate estate taxes; he would move the US to a territorial tax system, meaning that the government would only collect taxes earned on American soil which would leave all foreign income of U.S.-based international corporations untaxed. Taxes would fall at all income levels, with high-income households benefiting the most. According to the Tax Policy Center, his plan would lose the US $6.8 trillion in revenue over the next decade.

Key Endorsements: Former NY Governor George Pataki, Former GOP Candidate Bobby Jindal, South Carolina Governor Nikki Haley

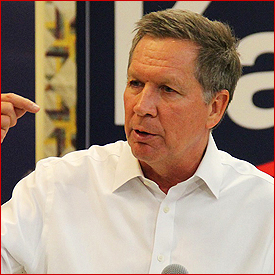

Governor John Kasich

Governor John Kasich (R – OH)

Campaign Pledges

Expand Charter Schools, Standardized Testing: As CBS News reports, “Kasich champions the expansion of charter schools, more school vouchers that allow state residents to attend the school of their choice, even if it is a private or religious school, and the increased use of testing to evaluate teachers’ success.” As his website puts it, “Ohio has quadrupled the number of available vouchers and increased the number of schools whose students are eligible for vouchers.”

Gun Proliferation: Kasich opposes any public efforts to enact gun safety regulations. His website includes this heading, “Removing Burdensome Restrictions for Law-Abiding Concealed Carry Licensees” and notes, “John Kasich enacted legislation protecting Ohio’s concealed carry laws, including protecting the privacy of permit holders and allowing for reciprocity licenses with other states where permit holders can carry their firearms.”

Ground Troops to Fight ISIS: Kasich believes in sending American ground troops to Iraq and Syria to fight ISIS, telling CNN, “Mark my words… at some point it will require boots on the ground for the world to be able to deal with this problem,” adding, “[T]o say that we’re going to stop ISIS by just dropping bombs, it’ll either preserve the status quo, or they’ll make slight gains.”

Tax Plan: Gov. Kasich’s tax plan would lower the top individual tax rate from 39.6% to 28%, reduce long-term capital gains tax rates to 15%, eliminate the estate tax, lower the top business tax rates from 35% to 25% and double the research and development tax credit for small businesses. According to Robertson Williams, a senior fellow at the Tax Policy Center, “This looks like a pretty big tax cut for the top end and a little bit at the bottom.”

Key Endorsements: Former California Governor Arnold Schwarzenegger, TV Personality Montel Williams, Alabama Governor Robert J. Bentley

Dr. Ben Carson

Ben Carson, MD

Campaign Pledges

Healthcare: Dr. Carson said in a 2013 speech: “Obamacare is really I think the worst thing that has happened in this nation since slavery. And it is in a way, it is slavery in a way, because it is making all of us subservient to the government, and it was never about health care. It was about control.”

Climate Change: Carson does not believe that humans are causing the planet to warm. “I know there are a lot of people who say ‘overwhelming science,’ but then when you ask them to show the overwhelming science, they never can show it,” he told the San Francisco Chronicle. “There is no overwhelming science that the things that are going on are man-caused and not naturally caused.”

Prohibit Muslims from Becoming President: Carson told NBC News, “I would not advocate that we put a Muslim in charge of this nation, I absolutely would not agree with that.” Asked for clarification, Carson said that a requirement for the Presidency should be that “you have to reject the tenets of Islam.”

Tax Plan: Dr. Carson has said that his tax plan is “based on tithing.” It would impose a 14.9% flat tax across the board for income above 150% of the poverty level. He would also eliminate the estate tax, taxes of capital gains and dividends, and the Alternative Minimum Tax, and allow business to immediately write off the full cost of investments.

Key endorsements: Actor Mickey Rourke, Actor Kirk Cameron, MMA Fighter Vitor Belfort